1) IPO model

IPO模型

1.

Study on the Environment Impact Evaluation Method of the Cutting Manufacture Process Based on the IPO Model;

基于IPO模型的切削加工过程环境影响评价方法研究

2) IPO process model

IPO过程模型

1.

Based on IPO process model and Leopold interaction matrix,and taking the corrugated packing boxes of refrigerators with 544×528×1562 mm-50kg-201 L as an example,this paper made list analysis of the performance of resources and environment for this three procedures in continuous production process,and finally,made comprehensive evaluation on environmental influence in whole continuo.

基于工艺IPO过程模型和Leopold相互作用矩阵,以544×528×1562 mm、45 kg、201 L电冰箱瓦楞包装箱为例,对连续化生产工艺中的3道工序分别进行了资源环境性能的清单分析,最后对整个连续化生产工艺流程的环境影响进行了综合评价。

3) IPO pricing model

IPO定价模型

1.

And a new dynamic IPO pricing model was established on the basis of five internal and external factors including the industry average price-earnings ratio, earnings per share, net assets per share, share ratio in circulation and annual growth rate.

利用多因素逐步回归法对IPO(Initial Public Offerings)定价变量进行调整,选取行业平均市盈率、每股收益、每股净资产、发行后流通股比例和年成长率共5个内外部因素,建立了动态化的IPO定价模型。

2.

Based on the review of existed pricing theories,this paper attempts?to?establish an IPO pricing model by regression analysis of several factors,which are assumed to have impacts on IPO pricing and conducted by tests at last.

在回顾以往定价理论的基础之上,试图通过对影响IPO定价的诸多因素的回归分析,建立一个IPO定价模型,并对之进行检验。

4) Initial Public Offerings

IPO

1.

Initial Public Offerings Pricing Research;

上市公司IPO定价问题研究

2.

IPO(Initial Public Offerings) Underpricing means that the offer price of IPO is lower than the market price, which shows that the first-day closing price is obviously greater than the offer price.

IPO抑价是指新股一级市场的发行价低于二级市场的上市价,表现为新股发行上市首日的收盘价明显高于发行价,上市首日能够获得显著的超额收益。

3.

This paper provides a comprehensive analysis on the characteristics&methods of Initial Public Offerings(IPOs), offeringprice,first day s closingprice and listing day stock return etc.

其中,上市日指数,发行价格一直是初始收益率的主要指标,发行日景气指数,流动比率及流通股比值也是发行人及承销商所需要共同考虑的因素,行业因素再次之,发行定价政策及制度在新股发行定价中起着重要作用;本文最终选取了发行价格,每股收益、发行数量、上市日指数情况及中签率五个变量构建了IPO首日收盘价格的模型,对最近上市的三只新股进行预测,模型的预测效果尚好。

5) initial public offering

IPO

1.

In the article,the writer gathers the data of thirty companies stocks,uses Eviews and Excel in the principle of econometrics,and proves that there is a phenomenon of initial public offering underpricing in Shanghai stock market.

IPO抑价现象在发展中股票市场上是十分普遍的现象。

2.

The long-term return ratio of initial public offerings(IPO) is one of the hot spots in the IPO fields.

我国股市上首次公开发行股票(In itial Pub lic O ffering,简称IPO)的长期收益率问题一直是IPO领域研究的热点问题之一。

3.

The primary stock market in China is characterized by excessively high initial rate of return for new stocks, low degree of marketization in the pricing of initial public offerings and heavy speculation.

我国一级市场新股初始报酬率过高 ,IPO定价市场化程度低 ,一级市场投机现象严重 ,这恰是目前无“绿鞋”期权的情况下 ,承销商与一级市场投机者之间博弈的纳什均衡产生的结果。

6) IPOs

IPO

1.

Ownership Structure as a Signal to Reveal the Intrinsic Value of IPOs;

IPO公司股权结构对公司价值的信号显示作用

2.

The first step of the article is to conceive of the 3 factors which influence IPOs: the first factor is firms’demand for capital, i.

IPO数量存在很大的波动性。

3.

The conclusion is make that the long-term performance of these IPOs overperforms the index performance, which in a sense indicates the booming of China Concept shares.

为研究中国企业海外IPO的长期绩效,本文采用平均累积超额收益率(MCAR)、购买持有期收益率(BHAR)和财富相对数(WR)几个指标对香港、新加坡、纳斯达克和纽约四个交易所上市的中国股票自上市以来至2007年的股价数据进行了分区域和分时段的长期绩效研究,研究发现中国企业海外IPO并没有呈现长期弱势表现,各项长期绩效指标反而略超大盘,只是数值偏小。

补充资料:AutoCad 教你绘制三爪卡盘模型,借用四视图来建模型

小弟写教程纯粹表达的是建模思路,供初学者参考.任何物体的建摸都需要思路,只有思路多,模型也就水到渠成.ok废话就不说了.建议使用1024X768分辨率

开始

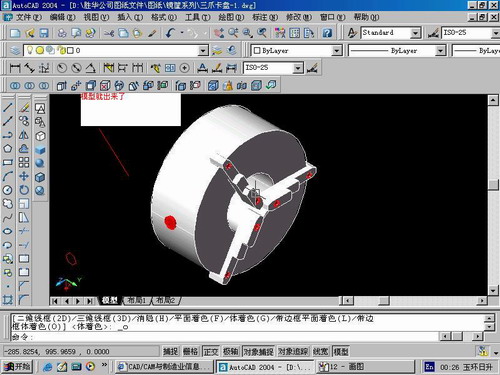

先看下最终效果

第一步,如图所示将窗口分为四个视图

第二步,依次选择每个窗口,在分别输入各自己的视图

第三步,建立ucs重新建立世界坐标体系,捕捉三点来确定各自的ucs如图

第四步,初步大致建立基本模型.可以在主视图建立两个不同的圆,在用ext拉升,在用差集运算.如图:

第五步:关键一步,在此的我思路是.先画出卡爪的基本投影,在把他进行面域,在进行拉升高度分别是10,20,30曾t形状.如图:

第六步:画出螺栓的初步形状.如图

第七步:利用ext拉升圆,在拉升内六边形.注意拉升六边行时方向与拉升圆的方向是相反的.

之后在利用差集运算

第八步:将所得内螺栓模型分别复制到卡爪上,在利用三个视图调到与卡爪的中心对称.效果如图红色的是螺栓,最后是差集

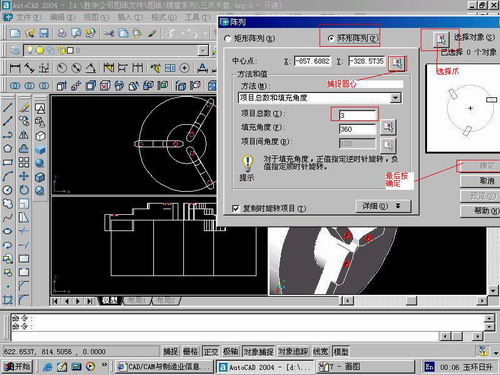

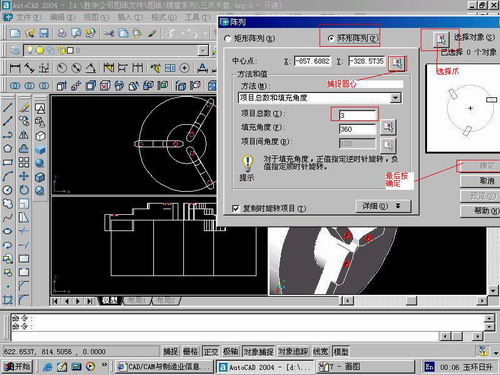

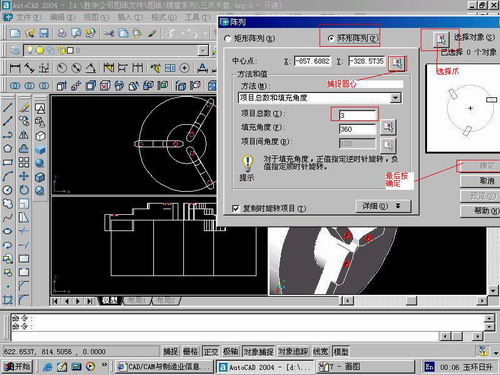

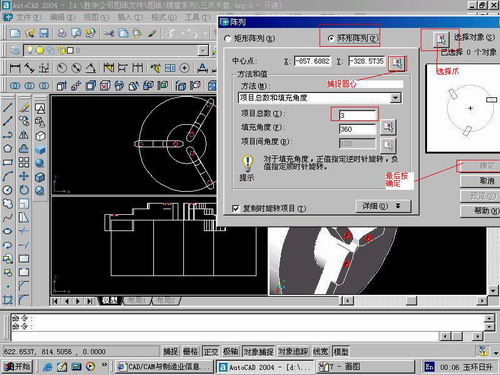

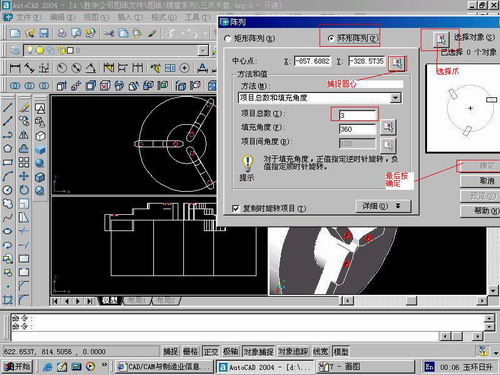

第九步:阵列

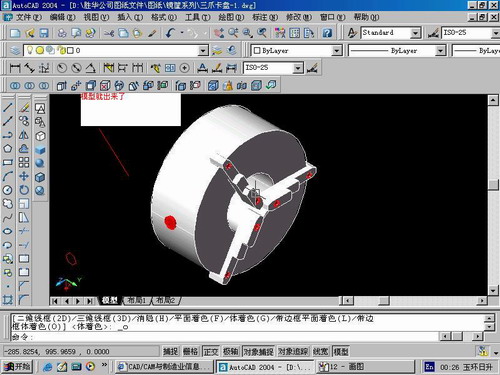

第10步.模型就完成了

来一张利用矢量处理的图片

说明:补充资料仅用于学习参考,请勿用于其它任何用途。

参考词条