1) tax type

税收类型

2) Tax

税收

1.

An Analysis on Tax Policies Promoting the Chinese Oil Enterprises Going Global;

以税收手段促进中国石油企业海外发展

2.

Analysis on overloaded tax burden of enterprise of coal industry and suggestions;

煤炭企业税收负担过重的原因分析与建议

3) tax revenue

税收

1.

Discussion of microscopic tax revenue preparation of small and medium-sized enterprise;

浅议中小企业微观税收筹划

2.

The high increase in the tax revenue since the reform of the financial system of tax division is an important phenomenon in the national economic life of China.

分税制财政体制改革以来的10年税收高增长,是我国经济生活中一个重要现象。

3.

Existing tax polic y, tax system and tax revenue collecting, etc.

加入WTO后 ,将不可避免地对我国现有的税收政策、税收制度和税收征收等方面产生重大的影响 ,这要求我国税收政策的制定、税制的设计以及税收的征收 ,不能违背WTO的基本原则。

4) Taxation

税收

1.

The Inference of Electronic Commerce on Taxation and its Strategies Research;

电子商务对税收的影响和对策研究

5) revenue

税收

1.

Design and Realization of House Property Revenue Integration Management Software;

房产税收一体化管理软件的设计与实现

2.

The Investment and Distribution in Enterprises Modeled as a Differential Game Based on the Revenue;

税收存在下的企业投资与分配的微分对策

6) taxes

税收

1.

A reinsurance model of maximization of dividend with taxes;

带税收的红利最大化再保险模型研究

2.

With the perfection of socialist market economy,we have established such a new levy and management mode which is based on taxes paying declaration and service perfection,relying on computer and internet technology,centralized Levying,focused checking.

税收征管是整个税务工作的前沿阵地和关键环节。

3.

The model has an optimal solution of the capital structure by joint effect of taxes and bankruptcy cost and may carry conveniently out empirical test, also.

在MM 原命题的基础上, 首先通过对Miller 的论文“负债与税收”的简单介绍, 分析了个人所得税对资本结构的影响, 在此基础上通过引入破产成本, 建立了一个统一的分析模型, 得出税收和破产成本的共同作用, 使得资本结构有一个最优解。

参考词条

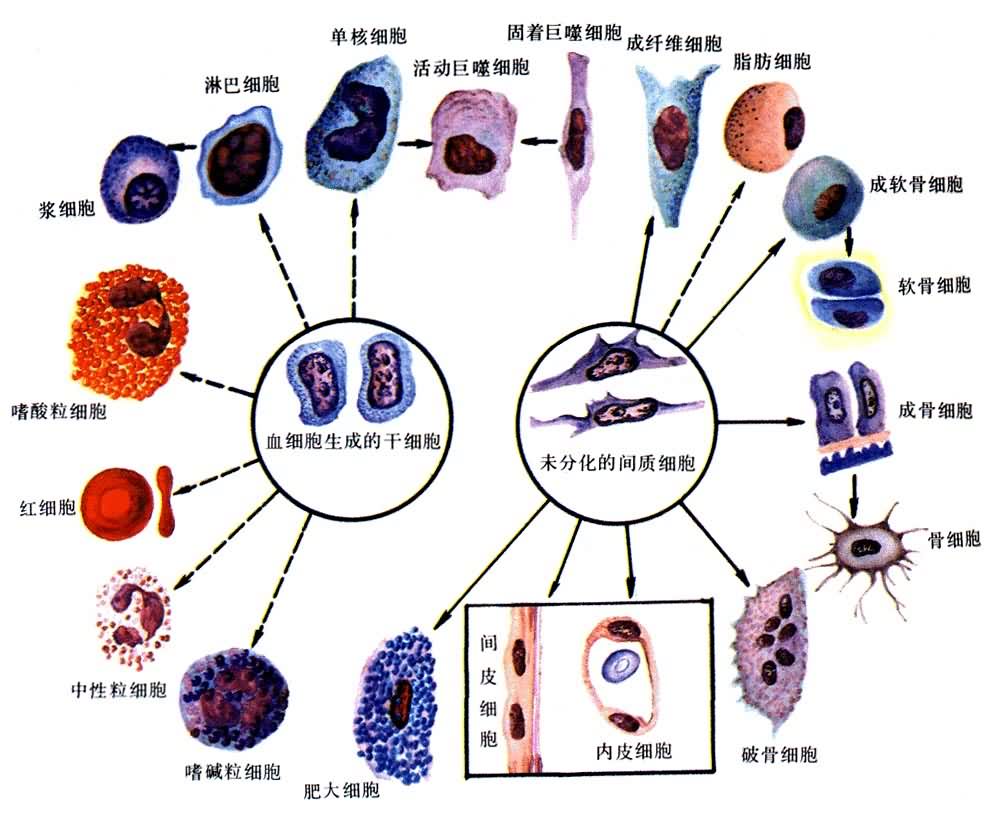

补充资料:血液有形成分各种类型的血细胞虚线指示中间类型的细胞。

李瑞端绘

[图]

说明:补充资料仅用于学习参考,请勿用于其它任何用途。